We are seeing an increase in the number of attacks and methods used to scam banks and their customers. With COVID changing the way we work, communicate and shop, the scammers have new channels and methods to carry out their attacks against unsuspecting victims. Here are a few of the most common banking scams to be on the look out for:

- Overpayment scams: Someone sends you a check (sometimes related to an online purchase) and instructs you to deposit it and wire a portion of it back to them (usually described as fees). But the check was fake, and now you’ll have to pay back the bank and you lost any money you wired. This is a very popular scam on Craigslist, Facebook and other online market sites.

- Unsolicited check fraud: Someone sends you a check for no reason. If you cash it, you may be authorizing the purchase of items or signing up for services or a loan you didn’t intend to.

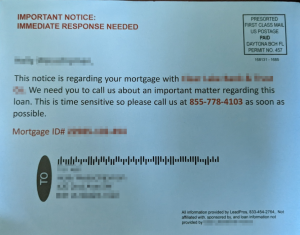

- Fake communications from “Your Bank”: Scammers try all sorts of communication methods and will reach out to you by letter, postcard, phone, email, text messages, and social media, all in an attempt to get your information and money. They may be telling you about a “great deal,” indicating there is “immediate response needed,” or asking you to confirm bank info due to “suspicious activity.”

- The below postcard is a recent example of “junk mail” that looks official, and may reference your mortgage with your actual bank. Public records were used to gather this information, but the number on the card is NOT your bank!

- The below postcard is a recent example of “junk mail” that looks official, and may reference your mortgage with your actual bank. Public records were used to gather this information, but the number on the card is NOT your bank!

If you suspect you have been the target of any of the above scams, call your bank directly to report the incident. Never give out sensitive information over the phone!

Scammers rely on exploiting their victims’ fear and readiness to trust messages that appear to come from official sources. Your first defense against these types of banking scams is knowing that a reputable bank will NOT contact you out of the blue and ask for your Social Security number, online account password or other personal information. If you get a phone call, text, email, or letter saying there is a problem with your bank account, call your bank on a number you know to be legitimate. You can then be certain that you’re speaking to someone at your bank. If there is a problem, they will help you address it.

As always, NGT is here to help! If you have questions, contact ngthelp.com.